The Land Acquisition Strategy in Romania for the development of a 100 MW wind farm. This is structured in clear stages.

Wind Energy & Wind Farm Investments Romania

We have extensive experience in the acquisition of agricultural land and the development of wind and photovoltaic projects. This allows us to find the best locations. We also enhance investment processes. Our knowledge covers market analysis. We deal with legal regulations. We carry out energy potential assessment. We make sure that the steps are efficient and sustainable. We collaborate closely with land owners. We also collaborate with local authorities. We work alongside specialists in the field. The goal is to maximize the benefits of each project. Thus, we contribute to the transition to green energy sources.

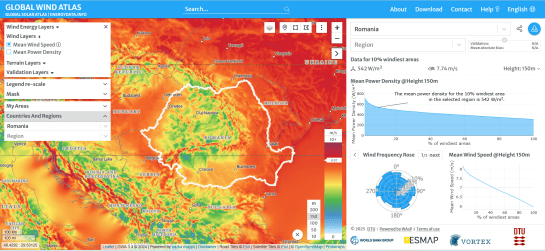

Romania’s wind corridors, especially in Dobrogea and Moldova, offer exceptional potential for wind energy development. We connect investors with landowners and offer full support for wind farm projects.

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Land Acquisition Strategy for 100 MW Wind Farm in Romania

Wind Farm in Romania – Stage 1 – Defining land requirements and technical criteria

Land rental for wind farm Romania – Wind farm configuration in Romania

For a 100 MW wind farm, ~12–20 turbines are estimated (depending on the unit rating 5–8 MW).

Gross area required: 1,500 – 2,500 ha (equivalent to 15–25 km²) for extended footprint.

Actual occupied area (turbine platforms, roads, station): ~2–4% of total.

Wind Farm in Romania – Technical criteria for the field

a. Area with average annual wind speed > 6.5 m/s at hub height.

b. Gentle orogarphy (slopes < 10–12%).

c. Least distances from homes according to regulations (500–1,000 m).

d. Access to roads and the possibility of their expansion for special transport.

e. Access to the electrical grid (110/220/400 kV substation nearby).

Check the average wind speed over an extended period of time. This should be done with 1–2 years of measurements or detailed historical data. Doing so provides a precise picture of climatic conditions and seasonal variations.

Analysis of wind resource maps.

Production estimation (P50/P90) involves detailed analysis of relevant variables. It includes trend forecasting to assess the potential performance of the project in the medium and long term.

Wind Farm in Romania– Overlays with restrictions

a. Natura 2000 areas, protected areas, etc.

b. Bird corridors.

c. Military targets, radars, height restrictions.

Preliminary verification of compliance with major siting restrictions: aeronautical restrictions (MOCA) and proximity to protected fauna (Natura 2000). These constraints may limit the utmost height of the turbines (reducing efficiency) or impose operational restrictions (curtailment).

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Wind Farm in Romania – Stage 2 – Identification of the target perimeter and cadastral analysis

Delimitation of the development perimeter based on wind studies, GIS and modeling (WindPro/WindSim).

Inventory of plots:

1. CF extracts, land registry notes.

2. Establishing the type of ownership (private, public, UAT, extravilan).

Verification of the legal situation:

1. Encumbrances, disputes, overlaps.

2. Existing lease regime or historical contracts. Identification of real owners (including co-owners, undivided heirs).

Wind Farm in Romania – Stage 3 – Community and authorities relationship strategy

Initial institutional contact with UAT:

1. Informing the city hall and the local council.

2. Assessing the community’s openness to the project.

Communication plan with landowners:

1. Simple presentation: benefits, compensations, impact.

2. Establishing a local point of contact.

Stakeholder mapping:

– Local opinion leaders, large farmers, key landowners.

Social risk mitigation:

1. Avoiding areas with historical conflict between landowners.

2. Avoiding excessively fragmented land (> 20 landowners/km²).

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Wind Farm in Romania – Stage 4 – Land acquisition/use model

Strategically, there are 3 main models:

A. Superficies contracts (most used in Romania)

1. Duration: 30–49 years

2. Right to build on someone else’s land.

3. Annual compensation per turbine + occupied surface area.

B. Leases

Applicable to agricultural land; limited by legislation; less flexible.

C. Direct acquisition (buy)

Recommended only for:

1. Transformer station

2. Cable junctions

3. Essential roads

4. Areas with unstable legal ownership

5. Higher cost, capital immobilization.

Optimal strategy for 100 MW:

→ large area – superficies,

→ nodes/station – buy.

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Wind Farm in Romania – Stage 5 – Land parcel structure

Turbine areas

– Large area arches, direct access.

Internal road color

– Width: 8–12 m.

Underground cable routes

– Areas not affected by restrictions.

Connection point / power station

– Ideal 3–5 ha, flat land.

GIS maps are created with the status of each plot:

1. Green = signed contract

2. Yellow = in negotiation

3. Red = legal blockage or refusal

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Wind Farm in Romania – Stage 6 – Negotiation strategy with owners

1. Establishing the financial package

a. Fixed annual rent per MW installed (e.g. €2,000–4,000/MW/year).

b. Compensation for roads, platforms, cables.

c. Annual indexation with inflation.

2. Competitive advantage

a. Upfront payment for the first 1–2 years.

b. Prioritization of large owners.

3. Solid legal structure

a. Pre-contract superficies choice.

b. Provisional registration right for safety.

c. Temporary access agreements for studies.

4. Transparent negotiation

a. No major price differences in the same area.

b. Presentation of benefits for the community (local taxes, road modernization).

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Land rental for wind farm Romania – Stage 7 – Risk Management

1. Legal risks – litigation, lack of cadastre, unresolved inheritances → solution: specialized lawyers, cadastral due diligence.

2. Social risks – local opposition → solution: early communication, public consultations.

3. Technical risks – difficult access, military or bird restrictions → solution: turbine repositioning, specialized studies.

4. Over-contracting risks – two companies are competing in the same area. The solution is rapid registration of the superficies right in the Land Registry.

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Land rental for wind farm Romania – Stage 8 – Finalizing the acquisition and consolidating rights

1. Signing of all primary contracts: surface/lease/buy.

2. Registration of rights in the Land Registry (provisional → definitive).

3. Obtaining continuous access rights for:

a. geotechnical investigations

b. wind measurements

c. archaeological & avifaunistic studies

d. execution of works

4. Establishing easements for cables and roads.

5. Creation of a technical-legal land register.

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Stage 9 – Layout optimization and preparation for authorization

1. Integrating real field data into the layout model.

2. Adjustments to avoid problem areas.

3. Establishing final locations for: turbines, roads, station.

4. Preparing documentation for urban planning certificate & environmental agreement.

Stage 10 – Continuous monitoring until FID

1. Renewal of expired contracts or those requiring adjustments.

2. Maintaining the relationship with the community.

3. Updating compensation and indexation.

4. Monitoring land speculation around the project.

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

A. Land-related cost components

1. Annual rate (area / rent) — current indicative practice:

- Reasonable range: €2,000 – €4,000 / MW / year. This varies greatly depending on region, grid access, market pressure, and package size.

- For 100 MW: at €2,000/MW/year → €200,000/year; at €4,000/MW/year → €400,000/year.

2. Advance payment / signing bonus

Practice: 1–2 years advance payment (to secure owners and reduce renegotiation risk).

Example: 2 years advance payment at €2,000/MW/year = €400,000 paid at signing.

3. One-off compensations (roads, platforms, agricultural compensation)

One-off payment for infrastructure works covers local road reconstruction, crop loss, and eco-compensation. The indicative budget is €1,000–€5,000 per hectare affected, depending on the type of land.

4. One-off purchases

For transformer station, connection point, road intersections: buying of 3–5 ha of land. Example: land cost 3 ha × local price (e.g. €5,000/ha rural = €15,000) — but in practice it can be much higher in areas with demand. I recommend: local market comparison + negotiation reserve.

B. Recommended business structure

- Mixed model: most land through 30–49 year surface contracts + buy for station/critical areas.

- Economic terms:

- Annual rate indexed to inflation (e.g.: CPI + 1%).

- Revision clause for major changes (e.g.: regulatory changes, major layout changes).

- Penalties for abusive termination / compensation for early termination.

- Peri-fix choice: small increase at signing (bonus) in exchange for the first period of exclusivity.

C. Simplified calculation example (30-year financial impact)

- Let’s take the conservative scenario: €2,000/MW/year → €200,000/year.

- Current value (PV) of these payments over 30 years at a real discount of 6%: ≈ €2,752,966 (annuity PV calculation).

- Conclusion: the cost of the land is material to the financing model. Negotiating the period, indexation, and bonuses significantly influences the NPV.

D. Practical financial recommendations

1. Budget allocation for due diligence + lawyers: 0.1–0.25% of capex.

2. Reserve for negotiation: keep 10–20% of the land budget for “hard to get packages”.

3. Payment structuring: combine small down payment + annual payments + bonus at FID (e.g. final or primo payment at the beginning of construction).

4. Tax options: check local owners’ income taxation (influence their asking price).

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

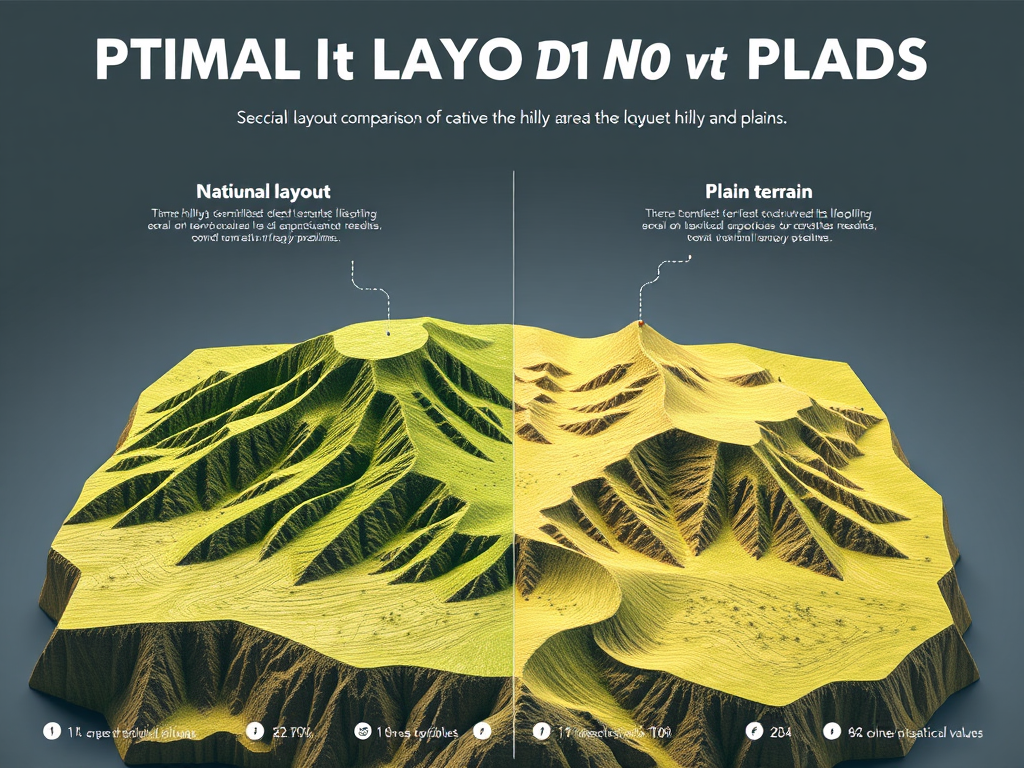

2) Optimal layout – hilly areas vs plains (principles & practical values)

The final layout depends on the turbine type (D rotors, rotor diameter D, hub height H).

A. Fundamental rules of positioning

1. Along-wind spacing (predominant wind direction): 7–10 × D (rotor diameter).

2. Cross-wind spacing: 3–5 × D.

Example: for turbines with D = 160 m → along-wind 1,120–1,600 m, cross-wind 480–800 m.

3. Setback from houses should follow local standard/regulations. If there is no local regime, use 500–1,000 m or calculate based on noise/shadowing.

4. Make sure components can be transported. Consider trenches, curves, and access angles when assessing the feasibility. Pay attention to the distance from main roads and high-voltage lines.

B. Layout for plain areas (flat land)

- Advantages: regular layout, high energy efficiency, easier to transport.

- Recommendation:

– Use regular grid in the direction of the prevailing wind; maximizes space utilization.

– Turbine pitch (~8 × D) for large modern turbines → reduces wake losses.

– Internal roads: “H” or “grid” layout to reduce overall length; widths 6–10 m (depending on transport weight).

– Underground cable routes: routes parallel to roads for easy access.

C. Layout for hilly/hilly areas

- Challenges: turbulence, wind direction changes, difficult access, higher foundation cost.

- Principles:

Position turbines on ridges or segments with favorable gradient (exposed to laminar wind).

Spacing can increase: along-wind 8–12 × D to limit wake losses in turbulent areas.

Avoid positioning on a steep slope >12% to reduce foundation and transportation costs.

Roads: use routes that follow contour lines where possible (reduce erosion) — but avoid very sharp curves for part transportation.

Offer sufficiently wide mounting platforms (e.g.: 25–30 m long × 10–12 m wide) for installation windows.

D. Technical layout elements that affect performance

• Wake modelling: run WindPRO/WindSim or equivalent; estimate net production; improvement should be done iteratively.

• Micro-siting: 1:1 scale decisions for each turbine after geotechnical/aviary/archaeological studies.

• Cabling and substation: reduce the total length of medium voltage (MV) cables to reduce losses and material costs.

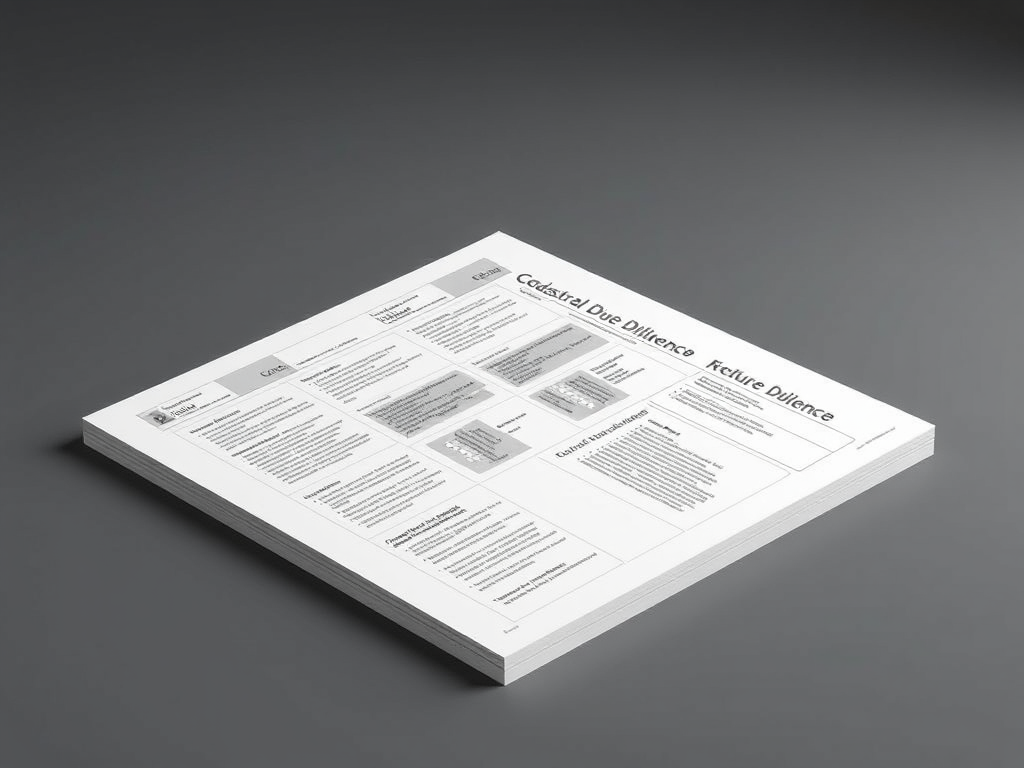

Land rental for wind farm Romania – 3) Checklist for cadastral due diligence (detailed, step by step)

Documents & initial checks

1. Land Registry Extract (CF) (current, original or legal copy): verify the owner, surface area, description of use.

2. Cadastral plan/surroundings (parcel plan): exact identification of the parcels.

3. Property history: sale-buy deeds, inheritances, lease agreements, preliminary contracts.

4. Check encumbrances & mortgages: registrations, encumbrances, pre-emption rights, mortgages.

5. List of co-owners: identity documents, inheritance certificates (if applicable).

In-depth legal checks

- Disputes & ambiguities: court history; notifications; protests.

- Existing easements: rights of way, networks, others affecting the site.

- Legal regime of the land (intra-urban/extra-urban) + urban restrictions (PUZ, PUG, urbanism certificates).

- Check utilities & networks: existing pipeline routes, sewers, power lines.

- Check special restrictions: protected areas, prohibited areas, Natura 2000 sites, archaeological sites.

Technical and administrative checks

a. Topography & surveying plan: determining boundaries, landmarks, elevations.

b. Road access identification: right of way, road width, need for partial expropriations.

c. Check for agricultural operations: existing leases, harvest periods, anticipated compensation.

d. Tax check: local taxes, tax obligations of the owner that affect the transfer.

Recommended contractual clauses & documents

Pre-reservation / option contract: exclusivity period + price/terms.

Surface contract: duration, payments, indexation, remediation clauses.

Temporary access clauses: for measurements (masts), geotechnical drilling, wind campaigns.

CF registration rights: procedure to register the surface right/lease.

Transfer / assignment clauses: what happens when the project is sold.

Compensation plan: for crops, harvest, road reconstruction costs.

Operational due diligence

Photo & geo-tagging audit: current images and descriptions.

Coordinate & boundary confirmation: field verification with surveyor.

Plan for unresolved inheritances: mechanisms for resolution or exclusion from the perimeter.

List of mandatory documents for CF: notarial deeds, declarations, consents, etc.

Final reports

Consolidated due diligence report: legal summary, risks, estimated remediation costs and recommendations (green/yellow/red for each plot).

Owner/plot/action strategy matrix: what we negotiate, buy, lease, avoid.

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

4) Full timeline 24–36 months to ready-to-build (GANTT logic and milestones)

Phase 0 — Initial Preparation (Month 0)

• Project team set up (lead dev, lawyers, surveyors, wind consultants, environmental).

• First due diligence budget allocation (0.5–1% capex).

• Goal: documentation, first data collection.

Month 1–6 — Resource studies & due diligence

1. Wind measurement campaign (anemometers/mast, LiDAR) — installation months 1–2; continuous measurement (ideally 12 months, least 6–12 months).

2. Cadastral due diligence & first negotiation — contacts with owners, preliminary options, provisional registrations.

3. Pre-EIA study (screening), first restrictions analysis.

4. Topography & preliminary geotechnical studies (pilot points).

Milestone M1 (Month 6): preliminary “Go/No-go” package based on partial wind data, due diligence and feed-in expectation.

Month 6–12 — Project development & initial authorizations

1. Wake modeling & preliminary layout → first micro-siting.

2. Continue wind campaign up to 12 months (recommended).

3. Start technical procedures for grid connection — ask for connection study from grid operator. (Takes 6–18+ months depending on country.)

4. Advanced field negotiations — signing options, pre-contracts, down payments.

5. Initial EIA / avifauna, archaeology studies (may overlap) — seasonal data collection.

Milestone M2 (Month 12): proposed final layout, majority legal package signed (≥70% surface), formal request for connection study.

Month 12–18 — Finalization of studies & authorizations

1. Completion of EIA studies (depends on results; includes public consultations).

2. Obtain urban planning certificate / local agreements (depends heavily on UAT).

3. Consolidation of land contracts: signing of definitive surface contracts; registration in the CF.

4. Completion of geotechnical studies for all locations.

5. Preparation of technical file for FID (estimated costs, CAPEX, OPEX).

Milestone M3 (Month 18): finished package for investment decision (FID prep). All land rights are confirmed. EIA studies are in progress and accepted in principle.

Month 18–24 (or 18–30) — Financing & FID

1. PPA / market negotiations (if necessary) — power sales contract or commercial appraisals.

2. Financial structuring: bank closing / equity.

3. FID (Final Investment Decision) — major contracts (turbines, EPC) are signed, financing is secured.

4. Contracting of main purchases (turbines, transformers, cables).

Milestone M4 (Month 24): FID — “ready-to-build” project (if all went well). In many contexts, FID can be 24–30 months away depending on the speed of obtaining network agreements.

Month 24–36 — Execution preparation (right before construction)

1. Obtaining final construction permits.

2. Mobilizing contractor, logistics, part transportation plan.

3. Preparatory works: access roads, platforms, preparatory foundations (can start right after FID).

4. Delivery of first components and site organization.

Final milestone (Month 30–36): physical start of turbine assembly; project considered ready-to-build (all land rights, permits and financing secured).

Buffers & risks (time)

• Allow/allow/problematic risk: add buffer +3–6 months.

• Grid risk (connection study/CEI): may delay FID — include alternative scenarios (inverter option, own station).

• Recommendation: plan timeline in three scenarios: optimistic (24 months), realistic (30 months), conservative (36 months+).

Quick summary & recommended next steps

1. Prioritize LiDAR/anemometer installation and start cadastral due diligence concurrently — these are critical for the investment decision.

2. Negotiate main land packages with a combination of down payment and annual indexed payments. Emphasize clauses that protect the project, like the right to register in CF.

3. Run wake modeling after 12 months of measurements for final micro-siting.

4. Prepare authorization fear (EIA) in advance — early public consultation reduces social risks.

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |

Ion Tudor – Investments Consultant

Mobile: +40 734.845.159

contact@investmentsinromania.eu

We offer Pasture Rental for Wind Farm in Romania | Land Rental for Wind Farm in Romania | Wind Farm Investment in Romania | We offer Land Rental for Wind Farm in Romania | Lands Rental for Wind Farm in Romania | Wind Farm in Romania |